China is preparing to launch a crude oil futures contract denominated in Chinese yuan and convertible into gold. Such a move not only has the potential to drastically change the rules of the global oil game but could also have consequential economic and geopolitical ramifications. Could this measure be a mere response to a perceived US proclivity to use the dollar and economic sanctions as a means of geopolitical coercion? Or could this be the end of Bretton Woods II happening before our very eyes? Is China just leading a parade away from the dollar to secure a larger slice of the SDR pie? Or could China be poising itself to ring the passing bell of the Petrodollar system? Is it even possible for Saudi Arabia to start pricing oil in Chinese yuan? Then, how likely is a scenario in which Saudi Aramco could serve as the bride in a “Heqin 和親”, or marriage alliance, between the house of Saud and Zhong Guo (China)?

China is now in the driver’s seat but many economists are still making commentaries from western text books. The reality is that this is probably the first time in recorded history that a developing country has been the largest trader in the world and, by many measures, the largest economy in the world. In fact, China has already overtaken the US in terms of GDP based on Purchase Power Parity (PPP). Moreover, the Chinese have the advantage of being perceived as non-judgmental when it comes to doing business with other regions in the world, such as the Middle East, without needing to feign their regard or lack thereof of any trade counterparty. The planned launch of the yuan-denominated crude oil futures contract could be another measure to capitalize on the recent escalation of economic sanctions and the draconian controls imposed on all financial transactions denominated in US dollar. With many European banks heavily fined for violation of sanctions regulations, the OFAC (Office of Foreign Assets Control) not only has jurisdiction over all transactions denominated in US dollars but is also able to enforce such rules globally, as these transactions are cleared through US institutions. The yuan-denominated futures contract has the potential to become the most important Asian oil benchmark, allowing oil exporters such as Russia and Iran to bypass US dollar denominated benchmarks. The new contracts will most likely be based on multiple deliverable Middle Eastern crude grades.

This also begs the question of whether this move is part of a larger de-dollarization strategy manifesting a larger geopolitical game afoot between great powers and as part of an intent to marginalize the power of the dollar in bilateral trade. We all remember the mammoth gas deals signed between Russia and China in 2014. The contracts stipulated that the exchange would not be done in dollars but in Renminbi and Russian roubles. These trade offset mechanisms were further enhanced by China opening an exchange in Shanghai where gold could be purchased in yuan.

This gold exchange is of paramount importance, given the fact that many trading counterparties, including countries in the Middle East, would like to avoid the US dollar in trade but are not ready to accept the idea of being paid in yuan. Hence, allowing these futures contracts to be settled in yuan and converted into gold would provide a lot of comfort for countries and societies where gold is still regarded as money.

The death of Bretton Woods II or a transition to a multiverse world

Some analysts have prematurely started mentioning a gold-backed Chinese yuan that could replace the US dollar as a reserve currency. However, the convertibility of the yuan settlements into gold does not imply that the yuan will necessarily be backed by gold, because the conversion rate will be based on the prevailing gold price and will not be fixed, as was the case with the US dollar under Bretton Woods I. Nevertheless, this new system will help mitigate the risk of convertibility of CNY. Sceptics even went as far as to question China’s ability to back all circulating Chinese yuan with physical gold. Such an analysis reveals a misunderstanding of the trade offsetting mechanisms China has been putting in place. We all remember the Chinese President’s trips to Asia, Africa and the Middle East inking currency swap agreements. This means that an oil exporting country would be able to offset the proceeds of the sale of oil against its imports from China and would only need to convert the trade surplus into gold. To summarize, if the same mechanism were to be extended to all sorts of trade, China would only need to possess enough gold to back its trade deficit. This reminds us of the Bretton Woods system, under which only foreign central banks had the right to exchange dollar holdings for gold. As dollars in the hands of American citizens were not exchangeable into gold, only the surplus had to be backed by physical gold. In recent years, China’s current account surplus from exports diminished dramatically and it might start turning negative imminently, making China a more consumption oriented nation.

But this barter system is already in place between Russia and China! The Russians are already selling their oil to China against Chinese yuan and then buying gold on the Shanghai Gold Exchange using yuan-denominated gold futures contracts. In March 2017, Russia’s Central Bank opened an office in Beijing to facilitate more transactions in gold as explained by the Head of the Russian Central Bank, Sergey Shvetsov.

“We discussed the question of trade in gold. The BRICS countries are large economies with large gold reserves and impressive volumes of production and purchase of this precious metal. In China, gold is traded in Shanghai, in Russia, Moscow. Our idea is to create a link between these sites in order to intensify trade between our marketplaces,”Shvetsov said.

From a financial engineering perspective, the new crude oil futures can also be replicated as a bundled solution combining yuan-denominated crude oil futures and gold futures traded on the Shanghai Gold Exchange.

Now that the world’s top importer (China) and exporter (Russia) are making progress in settling payments in gold, the greatest player that is still to get on board is Saudi Arabia. If the Saudis decide to sell oil to China in exchange for yuan, the other Gulf petro-monarchies will follow. Such a move by the Saudis would be risky, as it would undermine the petrodollar system, which coerces anyone wanting to buy oil to first buy dollars to pay for the trade. There is also a widespread perception that anyone that has attempted in the past to deviate from this understanding was dealt with swiftly. In other words, the US military “enforced” the deal Henry Kissinger made with the Middle East (led by Saudi Arabia). Since then the dollar has only ever been supported by international trade settlements, after the Nixon administration defaulted on its promise to deliver one ounce of gold for every $35. For years, big oil consumers led by China have been the biggest buyers of US treasuries but this has changed dramatically, with the Fed becoming the most important buyer. In fact, the Fed can continue playing this role and keeping interest rates artificially low as long as the government can continue spending to maintain the military supremacy that is key to perpetuating the status quo.

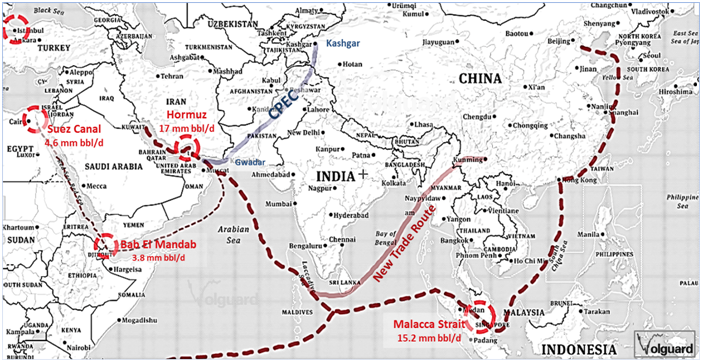

When all is said and done, the world wants peace and prosperity but if countries are offered a “fairer” way to settle trade, they might opt for it, especially if China can give assurance of military protection. China and Russia have already been sending signals to the rest of the world that they now have less fear of US military “retribution”. The One Belt One Road (OBOR) endeavour proposed by China’s leader Xi Jinping is a push to take a larger role in global affairs, with a China-centred trading network. This trade network will come in time to compete with the existing maritime trade lanes that are mostly secured by the mighty US blue water navy. Because historically almost ninety percent of trade in the world was done by sea, it could be said to be fair to denominate trade in US dollars and the petrodollar system was a way to get the rest of the world to finance or pay for such security of trade. Similarly, it is fair to assume that trade done through the OBOR infrastructure will be settled in Chinese yuan to compensate China for its investments and related risks. However, in real life, we don’t get what we deserve but only get what we negotiate for. A negotiation is taking place, but most economic analysts are still in a state of denial. Take for example the decision of the IMF, two years ago, to include the Chinese renminbi (RMB) in the basket of currencies that make up the Special Drawing Rights, or SDR. Most analysts focused on analysing how China deserved it but very few attempted to explain how China is negotiating for what it deserves.

The Chinese bride in the Arabian desert

For the petro-monarchies to pull the trigger and start selling oil in CNY, they will require a substantial Chinese pledge. China has already launched gigantic projects that could be regarded as a commitment to the region. For instance, the recent investments in the CPEC (China Pakistan Economic Corridor) which connects China Xinjiang province to the deep-water port in Gwadar was designed to help transport resources from the Arabian Sea to China by land. This new land route could shorten the oil sea-transport distance to China by 85%. The Sino-Myanmar Pipelines project is another land-based route that would diversify China’s crude oil imports routes from the Middle East and Africa, and break the Malacca Dilemma – a concept developed by the Japanese during the Cold War, when the oil and gas supply was highly dependent on the Malacca Strait, the only route that couldn’t be cut by the Soviet Union.

Nonetheless, the Gulf is not a homogeneous block and tensions persist in the region. Therefore, it would make perfect sense for the Saudis to ask for a Chinese commitment specific to Saudi Arabia. Centuries ago, such an assurance could have been achieved through “Heqin 和親”, or the marriage alliance, which refers to the historical practice of Chinese emperors marrying their princesses to the rulers of neighbouring states. But in the twenty first century, “Heqin” might sound too archaic compared to the concept of IPO (Initial Public Offering), although both practices can achieve similar risk-sharing objectives. In the case of Saudi Aramco, the world could see the biggest IPO in corporate history, with a value that is likely to exceed $2 trillion. The choice of the listing exchange is still uncertain but there are many indicators that favour Hong Kong, which is China’s biggest bourse that accepts IPOs by companies based in other countries. In fact, it is not only Aramco that sells most of its oil to Asia with China as one of the biggest buyers, but that also has investments in refining infrastructure in China (Fujian). The last agreement between Saudi Arabia and China to invest $65 billion in energy and infrastructure is also a good sign of the synergy that is taking place. If this IPO materializes then China Investment Corp, the nation’s sovereign wealth fund, and two of China’s state oil companies will be potential buyers of shares in Aramco.

New trading opportunities to harness the volatility of a regime change

In the short term, these new developments would open new opportunities for sophisticated investors to capitalise on important changes in volatility and correlation dynamics in Commodities, FX and Equity. In the long run, the advent of new instruments referencing local benchmarks will help offer superior hedging and risk management solutions to commodity consumers and producers alike.

Nevertheless, the prognostic above relies heavily on a peaceful transition. But will China succeed in convincing the current US administration that SHFE stands for Shanghai Future Exchange rather than “Stuff” Hits the Fan Exchange?